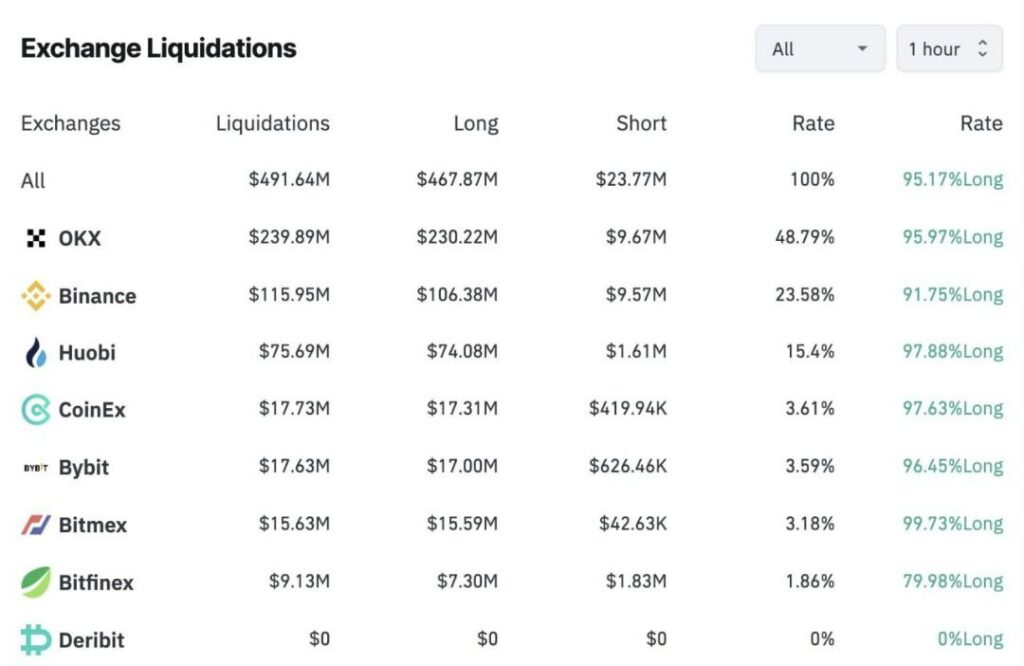

Rapid $500M Crypto Liquidations Shake Markets on Wednesday!

According to crypto analyist on X Bullion, this is the second largest alt liquidation in 2 years, not just bitcoin.

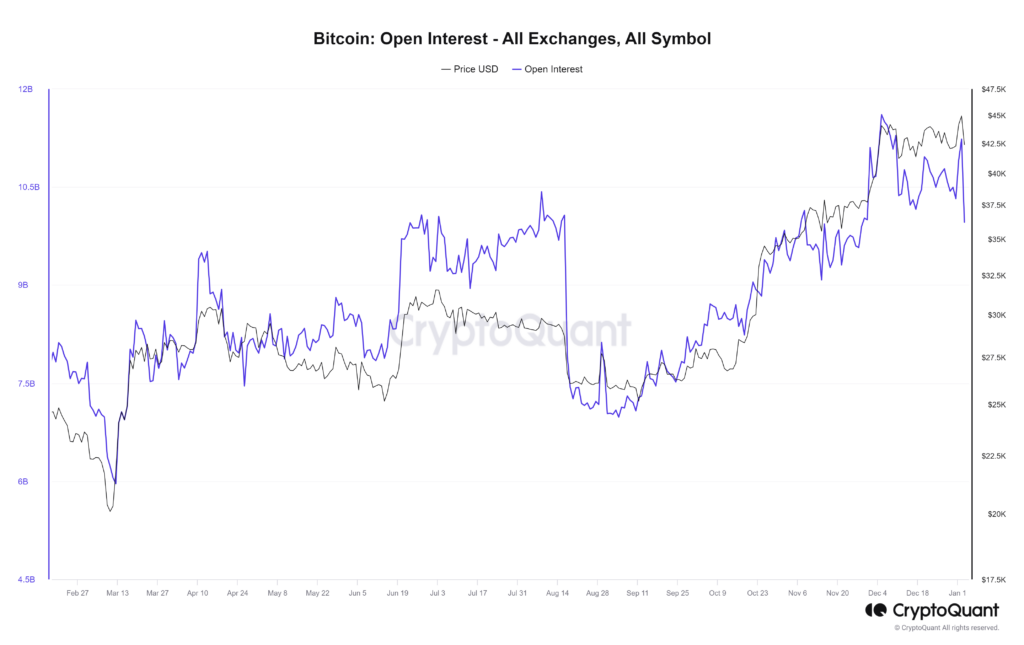

Let’s look at onchain data analysis site Cryptoquant. Bitcoin open interest also fell by over 12% in 24 hours. When open interest (OI) falls, it indicates that investors are closing out futures positions. This in turn could trigger the possibility of a long/short squeeze caused by a sudden price movement or vice versa. Open interest is defined as the number of open positions (including both long and short positions) that currently exist in the trading pairs of a futures exchange.

“The recent BTC crash is an ant-hunt and stop-loss hunt by major market players,” said PlanB, a well-known Dutch analyst who invented the Stock-to-Flow (S2F) model for predicting the price of bitcoin.

Beautifully executed stop-loss hunting.

Must kill leveraged longs before ETF pump. https://t.co/pC1j2tHpLw pic.twitter.com/bJfjtoPdOp— PlanB (@100trillionUSD) January 3, 2024

“The stop-loss hunt by the big players has been executed brilliantly,” PlanB warned, adding that “leveraged long positions should be stopped before the full price pump from the ETFs”.

Meanwhile, the BTC price plunge was also driven by speculation that the US SEC may reject all BTC spot ETF applications for approval in January.

“The US SEC will deny approval for the launch of all bitcoin spot ETFs for which applications have been received in January,” predicted crypto services provider Matrixport in a report published on Wednesday.

According to the report, ETF issuers have recently held frequent meetings with the SEC and have updated their applications to meet SEC requirements. However, MatrixPort noted that not all bitcoin spot ETF products have met the SEC’s requirements. These requirements are expected to be met in the second quarter.

There are currently five voting commissioners at the SEC, but their authority to approve spot ETFs is absolute. However, the SEC is currently controlled by Democrats and Commissioner Gary Gensler has expressed scepticism towards cryptocurrencies. If the SEC’s rejection in January is confirmed, most of the $5.1 billion in long bitcoin perpetual futures positions will be liquidated. In that case, BTC could drop 20% in an instant and retreat to the $36,000-$38,000 range, it warned. It recommended hedging long exposures if there is no news on ETF approval within five days.

“Even if the SEC rejects the ETF, we still expect bitcoin prices to be higher at the end of 2024 than at the start of the year ($42,000), as US election years and bitcoin mining years tend to be positive.”

View other articles:Bitcoin Market Update: On-Chain Data and Whale Activity Point to Potential Reversal

(Content created on Web3 Builders is copyrighted by Web3 Builders. Please credit the source when quoting. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.)